Ray White Now – Volume 61 – September 2023

Ray White Now – Volume 61 – September 2023

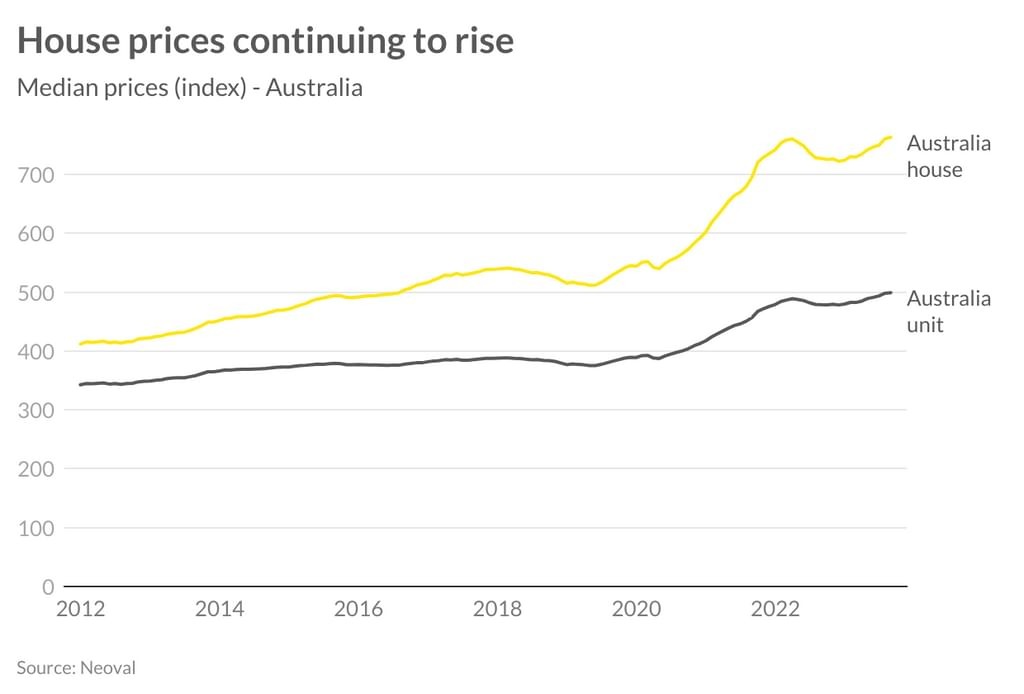

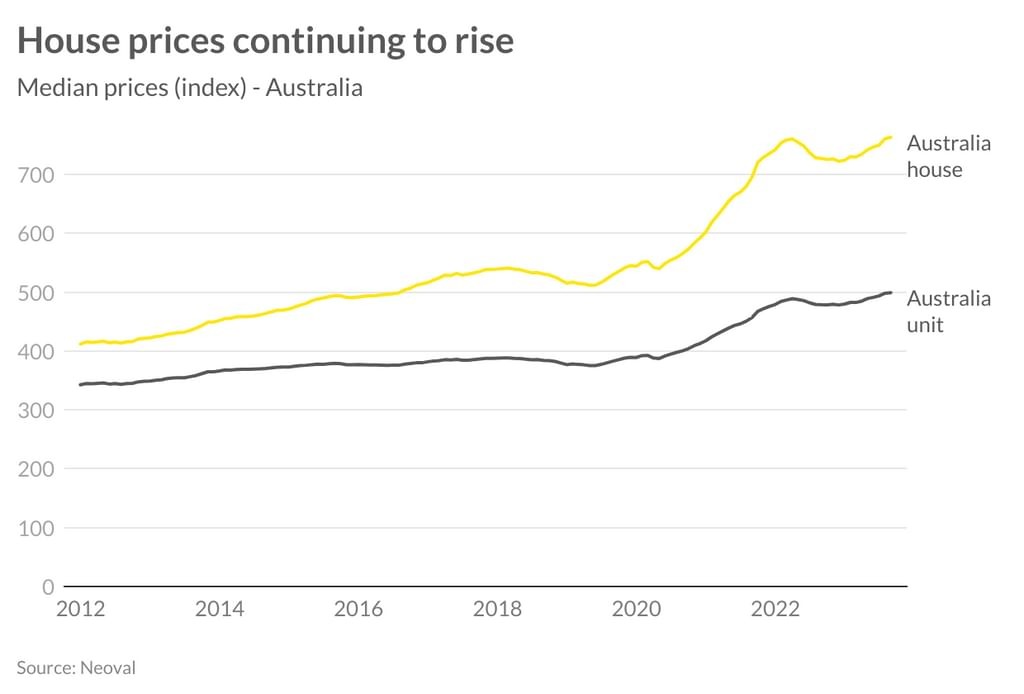

The property market continues to heat up with all capital cities now recording year-on-year price increases.

PRICE MOVEMENTS

PRICE MOVEMENTS

The property market continues to heat up with all capital cities now recording year-on-year price increases. While there was speculation that house price growth would slow once more properties became available for sale, this doesn’t seem to be the case. Buyer demand remains robust, despite finance costs and the relative difficulties in getting a home loan compared to 18 months ago.

In July, we saw prices decline slightly but this was more than reversed in August. The July fall was likely due in part to the surprise interest rate rise in June, as well as the first increase in properties available for sale. In August, the markets that saw the biggest price falls last year saw the biggest increases last month. Sydney topped the list with a 0.9 per cent increase for the month. On an annual basis, Adelaide and Perth are leading the way, recording well over six per cent price growth over the past 12 months. Melbourne and Hobart are the slowest growth capital cities.

Unit price growth is also strong with all capital cities now recording year-on-year unit price growth. Very strong population growth and building challenges have resulted in Brisbane recording the most growth. Brisbane units continue to see a faster rate of growth than houses.

While surprising that demand for housing is so high in such a high interest rate environment, it reflects strong population growth and a reduction in new home construction. Continuing strong rental growth conditions are leading more people to consider buying their own homes, while a lack of new home builds are pushing more into the established home market. With interest rates at or close to peak, it’s likely greater certainty about where rates will settle will also be a factor.

LISTING ACTIVITY

Over the past month, we’ve seen a lift in the number of properties for sale. There are a number of drivers for this. On one hand, rising interest rates and continued negativity towards landlords has led to an increase in the number of investors selling. More positively, increasing prices are encouraging more people to sell.

Ray White listing authorities didn’t increase in August as they had in July, though new listings could still increase if more authorities are converted into published listings. Authorities are seen as a strong lead indicator for future listings, with a lead of about a week before authorities become listings visible on the market.

AUCTION INSIGHTS

This strength in buyer demand is showing up real time at Ray White auctions. Despite the number of properties going to auction in August being 10 per cent higher than last year, the number of active bidders is up 27 per cent. There are now significantly more people bidding even though auction numbers are up.

This is also flowing through to clearance rates. More homes are selling with the clearance rate sitting at 75.5 per cent in August, up from 66.8 per cent at the same time last year. Early signs for September suggest that this higher level will be maintained.

Would you like an appraisal for your property?

If you’re thinking of selling or would like an up-to-date appraisal for your property, please fill out the form below and we will be in touch.